How Big is Tech Really?

How big is the technical diving market? What trends can we see? How many technical divers are out there? What are their typical careers? And what do we know about them and their purchasing behavior? Three studies in brief shed light on these questions.

Tags & Taxonomy

Know your customer

Every instructor candidate has to run through a lecture about the business processes of a dive center. The lecture includes information and concepts about customer processes, i.e. how to win new customers, do cross selling and to retain and develop customers. From an academic point of view, this knowledge is very basic. However, it can be enough to guide instructors to behave effectively in terms of doing business. What textbooks never describe is the specific customer and his or her typical profile. This is especially true for technical divers. It is time to sketch a more detailed picture of this customer.

The following descriptions are based upon several smaller studies that have been conducted by myself or my students during the Business Administration Studies program at the Interdisciplinary Future Laboratory “CreaLab” at Lucerne University of Applied Science and Arts.

Know your market: Which trends affect technical diving?

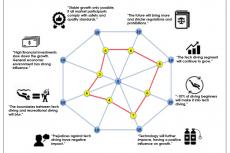

The first study focused on the question: How many tech divers are there globally? A group of students did research and conducted interviews with a dozen decision-makers within the international dive industry (Kaufmann, Koch, Lukacs, Suter, 2017). They started with the basic number of six million active divers worldwide provided by DEMA in 2015. Technical diving was defined with being minimally certified in “Advanced Nitrox.” The transcription and analysis of the interviews followed the standards of qualitative social research. The group identified eight central topics that the decision-makers regularly discussed (see Figure 1).

When reviewing the statements, it seems to be obvious that the technical diving market segment will continue to grow. Technological progress has a major impact on this development, because it lowers its entrance barriers. The growing number of female technical divers changes the demographics of the market and is an important growth potential. Ecological, economic and political aspects only have a limited impact, since the market is a mere niche of the overall sports diving market.

How many technical divers are out there?

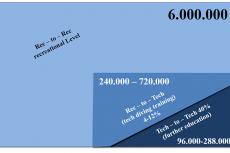

The share of technical divers among all recreational divers is estimated between 4-12%, depending on which dive association was asked. Larger institutions assumed lower numbers and vice versa. The true number should be in between, but closer to 4 than to 12%. An estimation around 6.0-7.0% seems to be realistic, and represents a part of 240,000-720,000, with a fair estimation around 400,000 divers (see Figure 2). Experts agreed that around 40% of technical divers sign up for further education and training programs. This results in a plausible estimation of around 160,000 active technical divers worldwide.

The study is an estimation, thus it is not representative, which is its key limitation. Also, it mainly focuses on the European and North American market, based on the experts selected. Developments in the rest of the world may be under-represented.

The typical technical diver’s career

A second study resulted by coincidence in September 2017. Well-known technical diver and photographer Becky Kagan-Schott launched a Facebook post in which she asked when people began recreational diving and then when with technical diving. The post developed dynamically, and I asked her for permission to use it for a detailed analysis. Two hundred and ninety-five people answered her question and 28% of the respondents were female.

On average, divers started their diving careers at 20.8 years of age (with peak values around 14, 18, and 29 years of age) and their technical diving careers at 30.2 years of age (with peaks at 21, 24, 30 and 33 years of age). The mean time until their entry into technical diving was 9.2 years, showing two distinct sub-groups with around five and 15 years: the “speedies” that worked through the initial recreational diving phase quickly, and the slower divers, that spent triple the amount of time to become technical divers. It is likely that every experienced instructor has distinct memories of both types of divers.

Again, most answers came from divers of the North America and Europe. The distribution of answers might look different in other parts of the world, but from my own personal impressions, these two market segments seem to fit.

Characteristics and purchasing behavior of technical divers

A third online study was completed in December 2018. This survey was more detailed and contained socio-demographic questions as well as items regarding experience and activity level, community behavior, different (self) management aspects and financing practices. The survey was carried out via the web tool Questback and was distributed within the community via several opinion leaders and dive associations.

All together, 900 interested persons opened the survey and 300 completed all questions. After quality control, 36 data sets were erased, so that the final data set contains 264 complete answers. In the subsequent step, the data was prepared for analysis (e.g. translation of currencies, unifying answer types, etc.). This data set is the first, high-qualitative and globally unique data set about technical diving! The study is representative with a confidence level of 90% and a standard error of 6.0%.

So, what were the most interesting facts about “tech divers” found through the study? In all, 226 men and 36 women completed the survey. We may assume that 16% represents the percentage of females in technical diving, which may be a little higher, since men are more active regarding online behavior. The average age was 44.2 years, and the average diving experience was 18.4 years in recreational diving and 8.7 years in technical diving.

Divers had logged 1,567.3 dives, with 99.2 dives per year and an estimated 133.6 hours of diving per year. That means, an average dive lasts 81 minutes. However, the percentage of dive professionals was around 55.3%, which means that many shorter training dives could have pushed the dive duration downwards.

Those surveyed were members in 1.8 dive associations (varying from 1 to 7). The percent of divers who were members of SDI/TDI was 26.4%, IANTD 21.5%, PADI 13%, GUE 8% and CMAS 5%. Not surprisingly, GUE shows the highest number of solo memberships, because unlike most training agencies, it includes a membership organization.

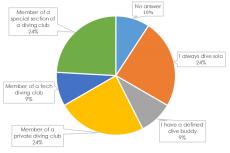

Regarding the dive partner management, the answers show the following behavior (see Figure 3):

About a fourth either dive solo, are members of a private dive club or members of a special section of a diving club. Only 9% have a regular dive buddy. The relatively high percentage of solo divers shows that diving alone is a common practice. It is not known whether the divers really go diving alone or just see themselves as being self-reliant when diving in a team.

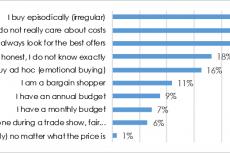

The consolidated answers regarding the purchasing behavior were also very interesting (see Figure 4). Nearly half of the participants describe themselves as episodic buyers. Almost as many clearly set an emotional priority and prefer passion over money. However, only 16% are spontaneous, almost a third look for the best offers, while 11% are chasing the best bargain, nevertheless. Most shop owners will painfully remember encounters with customers that turn out to be penurious hagglers. Surprisingly, only 9.0% mention an annual budget, and 7.0%, a monthly budget.

Although multiple answers were possible, few respondents (6%) seem to buy gear at a fair or trade show. Only 1.0% of those surveyed always buy the newest gear regardless of cost. We may conclude here that most technical divers primarily want to identify the best product to solve their problems, and the price is of less relevance. A product may be expensive, but this does not seem to be problematic if its function is well-proven. So, technical divers are commonly price-sensitive, but know that quality gear is valuable.

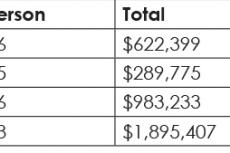

Finally, questions regarding the annual expenses (average) for equipment, training and travel were raised (see Table 1). Total spending for all respondents was US$622,399 for equipment, US$289,775 for training, and US$983,233 for traveling. Thus, their total budget is about US$1.9m for 264 respondents, or on a per-person basis: US$2,626 for equipment (36.5%), US$1,265 for training (17.6%), and US$4,166 for travel (57.9%)—in total: US$8,058.

This amount and its composition seem to be plausible, but a new diver could be turned away by this relatively high cost. However, this is only fair to avoid building wrong expectations. Technical diving is about life-support equipment and related techniques, and these are costly. End of story. It would be dangerous to save costs where training and life-support equipment are concerned.

So what?

Of course, all of the studies presented here are based upon assumptions, which are only representative for the technical diving community. Note that all of the respondents were people that a) can be reached via Facebook and Instagram, b) are active in North America or Europe, and c) were open to sharing their information. Nevertheless, we may summarize: If the technical diving market numbers 160,000 participants, then the total annual market volume would be $1.3 billion. So big is tech diving! ■

Jens O. Meissner is lecturer for Organizational Resilience and Risk Management at Lucerne University of Applied Sciences and Arts and for Management at University of St. Gallen in Switzerland. He researches management practices regarding technical diving as well as its necessary trappings. He has been diving since 1990. Today, he is a research diver and TDI instructor with 7Oceans, Horgen, Switzerland.

References

Kaufmann, D., Koch, L., Lukacs, M., Suter, M. An in-depth Analysis of the Global TecDiving Market. (2017). Unpublished Project Dissertation, Lucerne University of Applied Sciences and Arts, Department of Business, Lucerne, Switzerland.

Download the full article ⬇︎